What is CLOBr?

CLOBr aggregates liquidity from Solana DEXs into one view. See where the real support and resistance is.

What CLOBr does

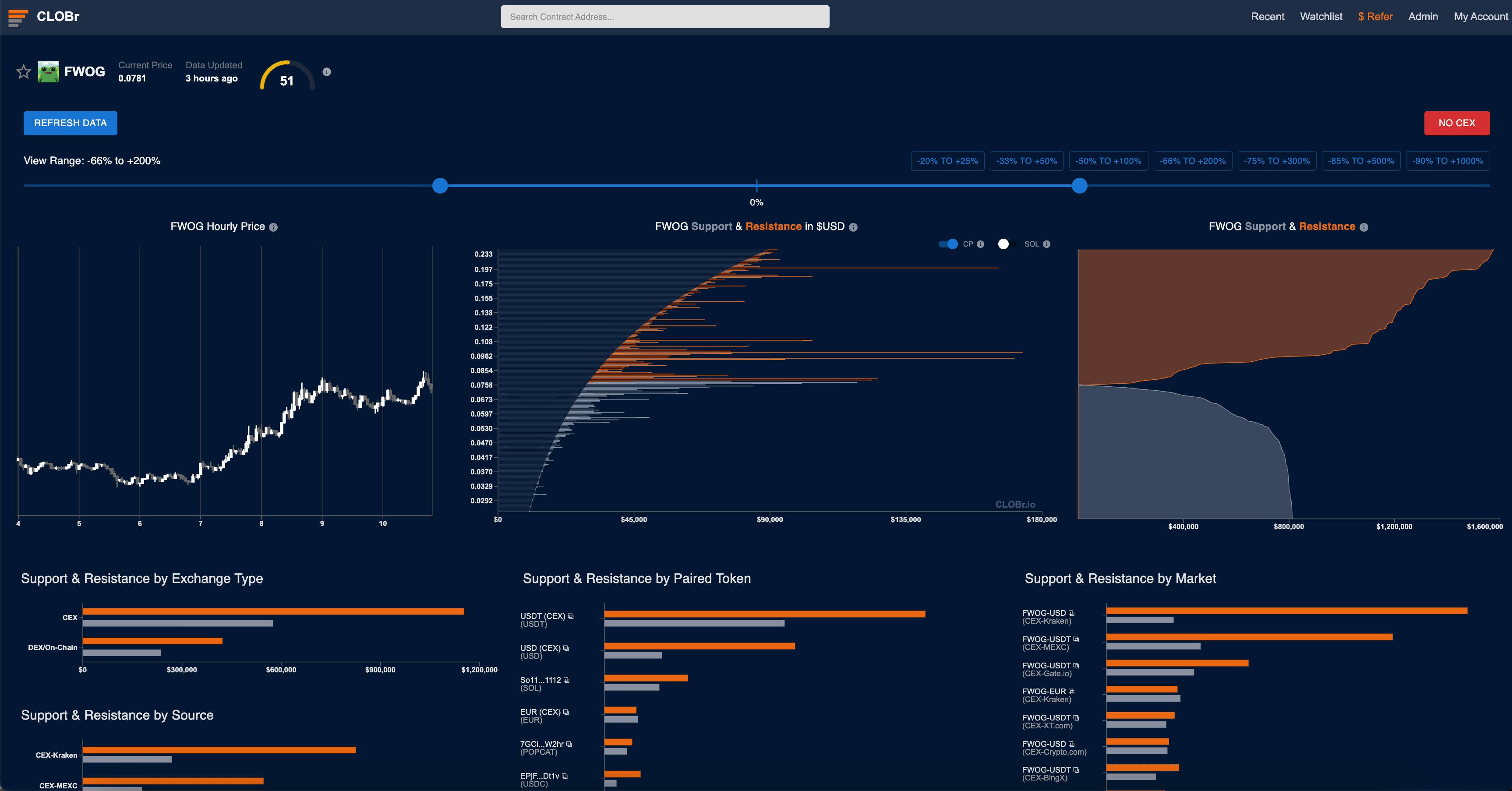

CLOBr aggregates liquidity data from Solana DEXs into a single depth-chart view. Concentrated liquidity positions, limit orders, DCA orders—all in one place.

CLOBr main interface

Why this matters

On CEXs, order books show where buy and sell orders sit. You can see support and resistance directly. In Solana DeFi, that data is fragmented across Raydium, Orca, Meteora, Jupiter limit orders, DCA programs — good luck checking all of them manually for every token you trade.

CLOBr pulls it together. One chart shows where real liquidity exists.

What you can do with it

See real support/resistance

Not historical price levels. Actual capital sitting at price points right now. Big buy wall at $X? That's where demand exists.

Find liquidity gaps

Price moves fast through areas with thin liquidity. CLOBr shows where those gaps are.

Size positions better

Know how much liquidity exists before you trade. A $100K sell into a $50K pool moves price more than you want.

Track DCA pressure

Jupiter DCA orders are scheduled. See incoming buy/sell pressure before it executes.

Data sources

| Source Type | Platforms | Significance |

|---|---|---|

| Concentrated Liquidity | Raydium, Orca, Meteora Concentrated Pools | The biggest support/resistance walls |

| Limit Orders | Jupiter | Precise price levels where orders sit |

| DCA Orders | Jupiter | Scheduled buy/sell pressure you can see coming |

| Constant Product Pools | Raydium, Orca, Meteora, Pump.fun, Fluxbeam | Calculates the actual price impact of concentrated liquidity |

| Centralized Exchanges | OKX, Binance, Bybit, Coinbase, etc. | Order book data from top CEXs for listed tokens |

Who uses it

- Spot traders timing entries and exits around liquidity walls

- Swing traders looking at multi-day market structure

- LPs finding ranges with less competition

- Perps traders using spot liquidity to inform leveraged positions

CLOBr vs charts

Price charts show the past. CLOBr shows the future - where capital is positioned now and will impact future order flow.

| Aspect | Traditional Chart Tools | CLOBr |

|---|---|---|

| Focus | Price history and patterns | Actual liquidity distribution |

| Support/Resistance | Based on historical price levels | Based on current capital deployment |

| Market Prediction | Pattern recognition and indicators | Actual capital committed at price levels |

| Data Type | Reactive (past price action) | Proactive (current liquidity placement) |

Next: how CLOBr actually collects and processes this data.