Introduction to Trading with CLOBr

Using liquidity data for trade entries, exits, and position sizing.

The basic idea

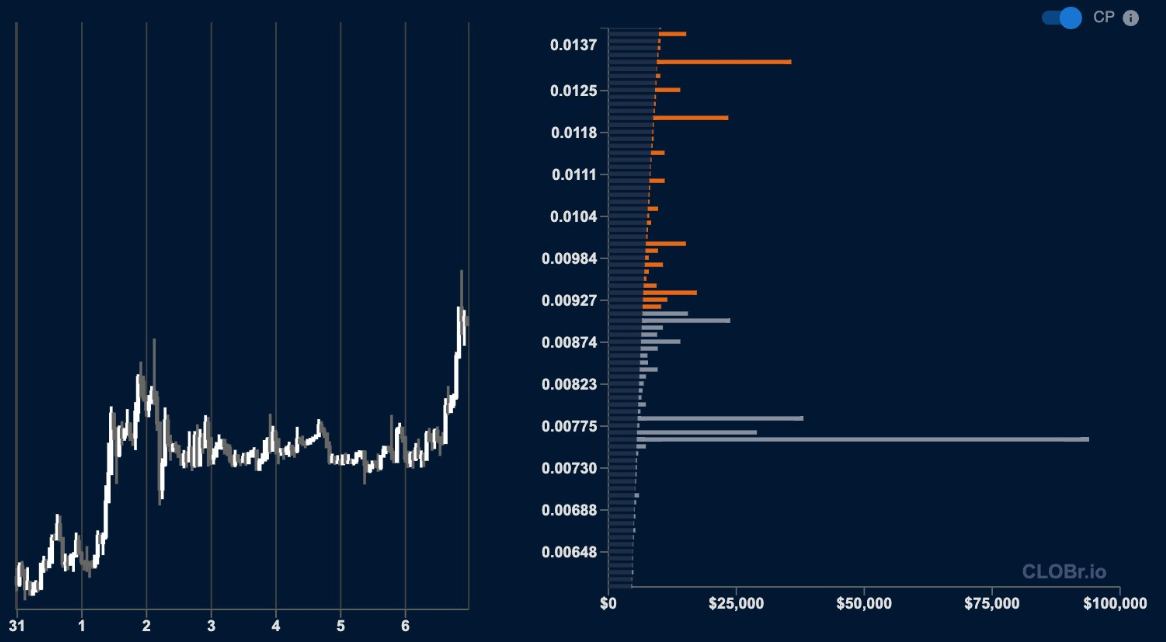

Price charts show history. CLOBr shows where capital is positioned now. Big buy wall? That's real support. Big sell wall? That's resistance you'll have to push through.

CLOBr depth chart shows a large buy wall, and the price respects the wall as support.

Use it with your existing analysis

CLOBr doesn't replace charts, indicators, or fundamentals. It adds one more layer: where is the actual liquidity? A historical support level means more when there's also a fat buy wall sitting there.

Things to keep in mind

Walls matter

Big buy wall = support. Big sell wall = resistance. Price often bounces off these levels even if they don't match historical price levels.

Wall composition matters too

A wall backed by stablecoins is more reliable than one backed by volatile tokens. Check pair exposure—if a "buy wall" is mostly in another memecoin, it's not as solid.

Watch for shifts

New walls appearing or old walls disappearing often precedes price moves. Someone knows something, or someone's positioning.

Gaps move fast

Areas with thin liquidity = areas where price can rip quickly. Could be opportunity (breakouts) or risk (slippage on your exit).

CEX vs DEX

CEX order books shift constantly as market makers reposition. DEX liquidity tends to be stickier—those concentrated LP positions don't move unless someone withdraws.

Strategies covered in this section

| Strategy Type | Market Condition | Primary CLOBr Feature |

|---|---|---|

| Swing Trading Meme Tokens | Volatile, trending markets | Liquidity walls as entry/exit points |

| Reducing Risk Ahead of Sell Walls | Uptrending, approaching resistance | Sell wall identification |

| Shorting on Perps Below Sell Walls | Topping patterns, major resistance | Sell wall quality analysis |

| DLMM Positioning Between Walls | Range-bound markets | Multi-level liquidity analysis |

| Buying on Top of Buy Walls | Pullbacks in uptrends | Buy wall identification |

Starting out

Watch first, trade later. See how price interacts with the walls CLOBr shows. When you do trade, start small until you trust what you're seeing.

Liquidity data is one input. It doesn't guarantee anything.